Stick with It: Your Guide to Budgeting

Posted by SageCreek Planning & Investments on Tue, 09/28/2021 - 10:51

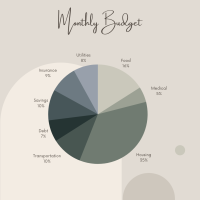

Budgeting is like anything in life: The more you make it a habit, the easier it becomes. The key is getting started, but you’d be surprised how many young people never think through that initial step.

Five Money Tips: Managing Your Credit Score

Posted by SageCreek Planning & Investments on Tue, 08/31/2021 - 15:02

Your credit score, often called your FICO score, represents to a lender how likely you are to pay your bills on time. It may determine whether you can get a loan, a job, an apartment, or insurance. A low score may prevent you from obtaining the lowest borrowing rates or the best loan terms.

Retirement Plan Choices for Small Businesses

Posted by SageCreek Planning & Investments on Mon, 08/16/2021 - 21:53

As a small-business owner, figuring out retirement choices can be a little intimidating. How do you pick the most appropriate retirement plan for your business as well as your employees?

Should I Wait to Start My Social Security Benefits?

Posted by SageCreek Planning & Investments on Mon, 06/28/2021 - 16:01

Deciding when to begin taking your social security retirement benefits can be difficult because there are many factors to consider. Even if you plan to keep working, social security benefits are available to most workers as early as age 62, but you can delay collecting up until age 70 or choose any age in between.

The CARES Act Student Loan Relief Options: Who Benefits and How?

Posted by SageCreek Planning & Investments on Wed, 05/12/2021 - 11:42

In response to the economic impact of COVID-19, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law on March 27, 2020. The U.S. Department of Education (DOE) announced an extension of this relief through September 30, 2021. The CARES Act encompasses a number of provisions that offer relief for student loan borrowers. If you have a student loan, here’s what you need to know.

Medical Risks Stabilize as Economy Continues to Improve

Posted by SageCreek Planning & Investments on Fri, 04/16/2021 - 13:45

Over the past two weeks, the medical news began to deteriorate as cases of COVID-19 and positive test rates went back up. Concerns existed as to whether the worsening numbers were a signal of another surge of the pandemic. But recent medical and economic data indicate that a significant fourth wave is not occurring.

Here’s What You Should Know About Bitcoin

Posted by SageCreek Planning & Investments on Tue, 04/13/2021 - 14:16

We’ve all seen the stories about bitcoin over the past few years—the triumphs and the pitfalls. For many investors, this cryptocurrency has raised a lot of questions and a lot of curiosity. Is bitcoin just a “scam” that will end in a meltdown? Or does it have the potential to revolutionize financial markets as we know them?

10 Reasons to Save for Retirement

Posted by SageCreek Planning & Investments on Thu, 04/01/2021 - 09:58

We all know we should be saving for retirement. But, according to EBRI’s 2018 Retirement Confidence Survey, many Americans aren’t prepared. In fact, 79 percent of respondents said they plan to work in retirement! Of course, life gets in the way of taking action, and retirement seems so far off. But whether or not you’re prepared, it will be time to retire before you know it. Read on for 10 reasons to make saving for retirement a priority today.

Women and the Pandemic: Planning for a Healthy Financial Future

Posted by SageCreek Planning & Investments on Thu, 03/18/2021 - 09:08

If you’re one of the many women whose lives and finances have been turned upside down by the pandemic, you might be struggling with what to do next. Fortunately, there are strategies to address your immediate concerns and help you plan for a healthy financial future.

Should You View Your House as an Investment?

Posted by SageCreek Planning & Investments on Fri, 10/23/2020 - 13:25

Comparing housing appreciation to stock market returns over the past year.