CHANGES TO YOUR RETIREMENT PLANS

There are some significant changes to your retirement plans starting January 1, 2020. The Internal Revenue Service announced cost–of–living adjustments for tax year 2020 and here are the highlights to know:

- Employee contribution rises to $19,500

- Combined employer and employee contribution rises $57,000

- Annual compensation limit for calculating contributions increases to $285,000

- Highly Compensated Employee limit increases to $130,000 The limitation regarding SIMPLE retirement accounts rises to $13,500

The Setting Every Community Up for Retirement Enhancement Act of 2019 – the SECURE Act – passed through the House of Representatives and the Senate and was signed by President Trump shortly before Christmas. While the SECURE Act contains 29 provisions aimed at helping Americans better save for retirement, here are a few highlights:

- It offers tax incentives to small businesses to set up automatic enrollment in retirement plans

- It allows many part–time workers to participate in employer–sponsored retirement plans

- It creates a new early withdrawal penalty tax exemption of up to $5,000 from an IRA to use for childcare costs

The tariffs will be in place on October 18th and are the most dramatic trade action against the EU since the Trump administration levied tariffs aimed at steel and aluminum last year.

MARKETS TURN IN A FANTASTIC 2019

Stock markets in the U.S. and around the globe turned in a fantastic 2019, driven by U.S. equities, specifically large–cap U.S. equities. And along the way, 2019 brought plenty of records, including:

- Record Highs. As the S&P 500 climbed consistently throughout the year, it also recorded 34 new record highs and turned in the best year in more than half a decade.

- Longest Expansion on Record. Earlier this summer, our current economic expansion passed the one from the 1990s to officially become the longest on record – more than 125 months and counting.

The major markets around the world put up some impressive numbers in 2019, with the MSCI EAFE Index just shy of a 20% return; the DJIA north of 20% and both the S&P 500 and NASDAQ up more than 30% on the year. And interestingly enough, most markets traded sideways from the April to September time frame, but rose significantly to close out the year – a marked departure from the end of 2018.

The equity and bond markets had a lot to digest in 2019: solid corporate earnings, continued historically low unemployment numbers, rising wages and no significant escalation in trade wars between the U.S. and China, the U.S. and Europe and the U.S. and Mexico/Canada. But there was one huge theme influencing the upward momentum more than others: shifting global central banks’ policy (namely the Federal Reserve and the European Central Bank) with respect to further monetary stimulus (i.e., cuts to short– term rates). And while the ongoing trade saga between the U.S. and China was never far from front-page news, the pivot from the Federal Reserve was much more impactful.

WHAT A DECADE

With all the stock market records broken in 2019, it's easy to forget the longer-term view, but we're reminded of that as we enter a new decade. With a cumulative return of almost 250% over the past 10 years, the past decade's stock market has been very strong, but has actually ranked fourth among the past seven decades.

While most of us were not investing during the 50s, many of us remember the returns of the 80s and 90s and marveling at the cumulative 400% returns of those decades. But the past 10 years were still remarkable, highlighted by the fact that it was the only decade on record that did not register a recession and just the second decade that did not experience a bear market (remember the 90s?).

| Decade | Stock Market Run |

|---|---|

| 1950s | 486.1% |

| 1960s | 112.2% |

| 1970s | 77.0% |

| 1980s | 403.8% |

| 1990s | 431.4% |

| 2000s | -9.1% |

| 2010s | 249.3% |

* Source: Bloomberg

YOUR PATH TO YOUR 2020 GOALS - SYSTEMS VERSUS GOALS

“If you're a coach, your goal is to win a championship,” writes personal coach James Clear. “Your system is what your team does at practice each day. If you're a writer, your goal is to write a book and your system is the writing schedule you follow each week. If you're an entrepreneur, your goal is to build a million–dollar business and your system is your sales and marketing.”

“Now for the really interesting question,” he adds. “If you completely ignored your goals and focused only on your system, would you still get results?”

Yes, says Clear, who can help spark new thinking in us regarding this year's goal setting. Let's create our own goal–setting template with just three short sets of questions.

- What did you accomplish in 2019? Personally? Professionally? What were the year's successes?

- What would you like to accomplish in 2020? Personally? Professionally?

- What do You need to succeed?

Put the first page on your left and put the second page on your right. Place the third page, with these questions, in the middle and let your brain connect your positive past to your envisioned future. What must you do to make those goals reality?

What habits and skills do you need to develop? What connections do you need to make? What activities should you try? Focus on systems and habits.

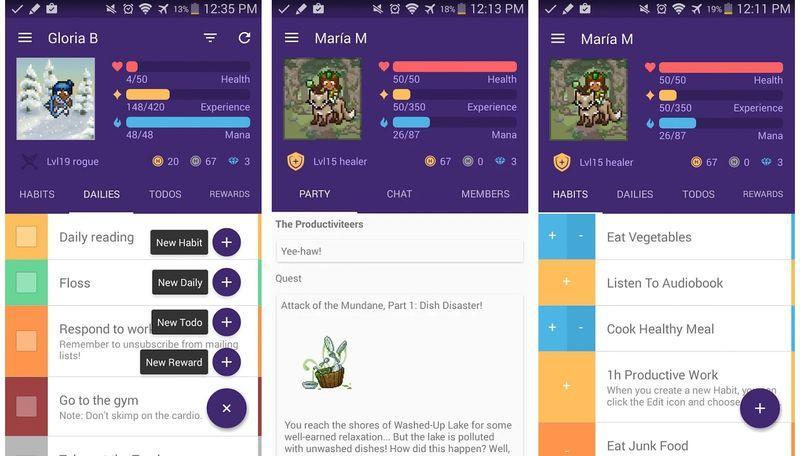

NEW APP SPOTLIGHT - HABITICA

Habitica is a free habit-building and productivity app that treats your real life like a game. With in-game rewards and punishments to motivate you and a strong social network to inspire you, Habitica can help you achieve your goals to become healthy, hard-working, and happy.

You can:

Battle monsters with friends. Say no more.

- Track your habits and goals

- Earn rewards for your goals

- Battle Monsters with friends

WHAT CAN WE EXPECT IN 2020?

Some are predicting the upward trend to continue into 2020 whereas others are predicting that the markets will retreat. No matter your outlook, the direction of the markets will be influenced by the same long–term and cyclical trends that have influenced the markets since the beginning – corporate earnings, interest rates and various macroeconomic data, including employment and wage growth numbers. And trying to predict the market performance for the next decade is even more foolish.

But one thing we know for sure is this: Past performance is no guarantee of future results. Ever.

|

NGI-1219-FMeX |

|

|