With the systematic withdrawal strategy, your assets are invested in a single, diversified portfolio aligned with your risk tolerance. During your working years, the goal is to maximize the return on your investment. Then, during retirement, you withdraw assets from the portfolio at a rate appropriate for your circumstances; a common withdrawal rate is 4 percent. There’s an inherent problem with this approach, however: you may be forced to sell in a falling market, liquidating a greater number of investment shares to meet your income needs and leaving fewer assets behind to recover.

The bucket strategy, which has become more popular in recent years, can avoid some of this downside. With this strategy, you still maintain a single, diversified portfolio during your working years. Then, approximately one to three years before retirement, you divide your assets among several portfolios, or buckets, each with different time horizons, asset allocations, objectives, and risks. With assets spread across these diverse buckets, you can more effectively manage the major risks to retirement income:

- Longevity risk, or the risk outliving your savings

- Inflation risk, or the risk that your expenses will outgrow your savings

- Market risk, or the risk that you will experience a down market during retirement

How It Works

To implement the bucket strategy, we first work with you to estimate your income needs throughout retirement, as well as the year or two before you retire. Once we know the approximate cash inflows and outflows you need to support your lifestyle during each retirement year, we can set up buckets and invest them to deliver on your income needs.

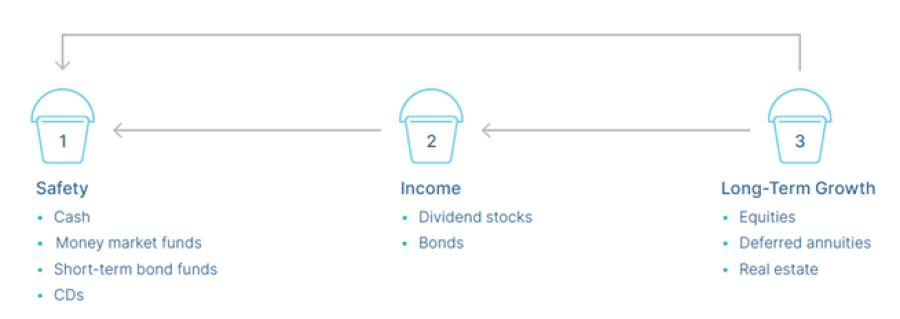

Typically, the bucket strategy is set up using three buckets, which, as previously mentioned, are invested based on different time horizons, objectives, asset allocations, and risks.

Bucket 1. This bucket covers more short-term needs, providing immediate income and cash for essential expenses as well as emergencies. Because it is invested in more liquid assets, such as short-term bond funds, cash, money market funds, and CDs, it helps to alleviate timing risk as well.

Bucket 2. This is an intermediate-term bucket, so it’s invested in riskier holdings, as there is more time to wait out market swings. Appropriate vehicles include bond funds, laddered bond portfolios, dividend-paying stocks, and deferred annuities. The annuities can serve as a source of guaranteed income, while the bond funds and bond portfolios can offer some appreciation potential.

Bucket 3. This bucket represents the long-term growth allocation piece of the retirement income plan. The goal is to help alleviate timing risk, inflation risk, and liquidity risk, as well as to further your estate planning objectives. As it has a long time horizon, this bucket is invested in more aggressive assets that seek some degree of capital appreciation—for example, equities, real estate, alternative investments, and individual bonds and bond funds. Deferred annuities would also be appropriate in this bucket.

Once the buckets are established, they can be managed in a couple of different ways. One way involves using up the money in each bucket in order: you would withdraw income and principal from the first bucket in the years assigned to it; then, you’d move on to the second bucket and do the same thing and then on to the third.

Another way to manage this strategy is to continually refill the first bucket with money from the other two, so it exists during your entire retirement period. For example:

- Periodically, we would sell down the investments in Bucket 3 that have appreciated. Then, we would take the proceeds and either invest in the securities in Bucket 2 or move the cash directly to Bucket 1.

- Periodically, we would sell down the investments in Bucket 2 that have appreciated. Then, we would take the proceeds and move them to Bucket 1.

- Instead of reinvesting the dividends, interest, and capital gains from Bucket 2 and Bucket 3, we would have them flow directly into Bucket 1.

With money always flowing into and out of Bucket 1, you may feel more comfortable about your financial security—both present and future.

A Better Way

As you approach your retirement years, understanding how to continue to live your desired lifestyle after you stop working will become increasingly important. By linking asset buckets to specific time horizons and income goals, and investing them in the appropriate vehicles, we can show you a better way to manage your retirement income.

These models are for illustrative use only, and you should meet with an advisor to discuss your personal risk tolerance and suitable recommendations. Investments are subject to risk, including the loss of principal. Some investments are not suitable for all investors. Investment strategies do not assure a profit or protect against loss in declining markets. No program can guarantee that any objective or goal will be achieved.

Annuities are long-term, tax-deferred investment vehicles designed for retirement purposes. Guarantees are based on the claims-paying ability of the issuer. Withdrawals made prior to age 59½ are subject to a 10 percent IRS penalty tax, and surrender charges may apply. Dividends are not guaranteed and the amount of any dividend may vary over time and fluctuate as market conditions change.